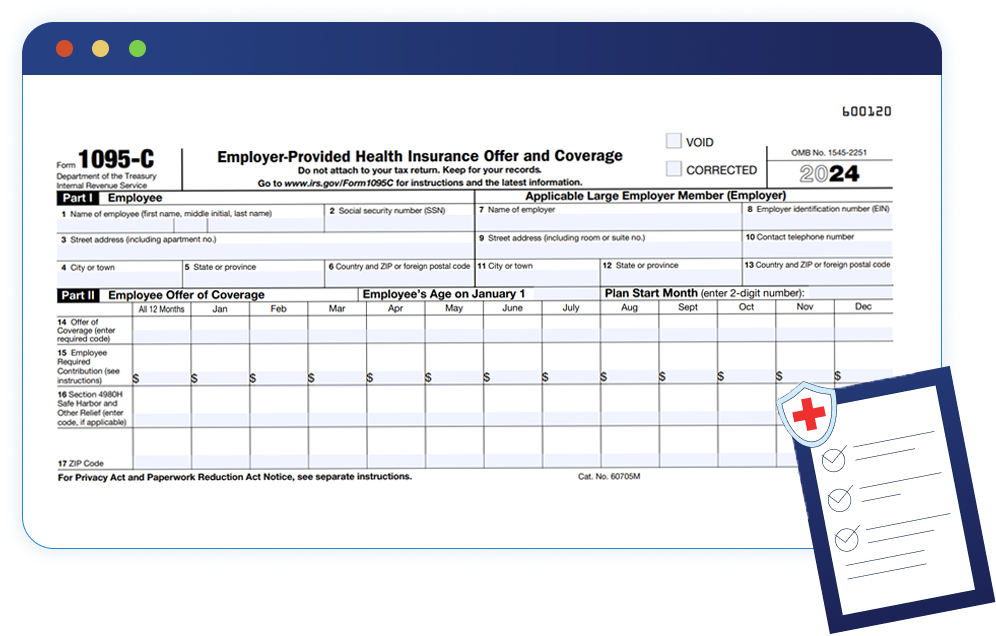

2024 Form 1095-C Filing Instructions

ACAwise, a customized ACA Reporting solution, generates ACA Forms with

Line 14, 16 codes and e-files them with the IRS / State and distributes employee copies. Learn More

What’s New: Form 1095-C has been released for the 2024 Tax Year

IRS Form 1095-C Filing Instructions for 2025

- Updated November 08, 2024 - 8.00 AM by Admin, ACAwiseEvery year, ALEs (Employers with 50+ employees) must report to the IRS about their offered health coverage information to the employees. The information is to be reported through Form 1095-C under section 6056.

These instructions will help employers better understand their ACA Form 1095-C Filing Instructions.

What is the purpose of IRS Form 1095-C?

The purpose of filing Form 1095-C, Employer-Provided Health Insurance Offer and Coverage by the applicable large employers is to report their employee’s health coverage information to the IRS.

With this, employers can communicate to the IRS that they offered qualified health insurance coverage to the eligible full-time employees, and the coverage meets the minimum essential coverage requirements.

When is the deadline to file Form 1095-C?

The deadlines for filing Form 1095-C with the IRS and furnishing copies to the recipient are as follows:

- March 03, 2025, is the deadline to distribute recipient copies.

- February 28, 2025, is the deadline to paper file Forms 1095-C with the IRS.

- March 31, 2025, is the deadline to e-file Forms 1095-C with the IRS.

Click here to learn more about ACA deadlines for 2025.

Instructions on How to Fill Out Form 1095-C?

These instructions will help you with completing the filing process of Form 1095-C.

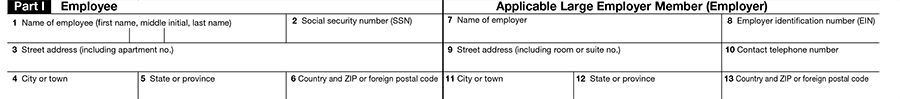

1. Instruction to complete Part I, Employee & ALE Member of Form 1095-C

Before proceeding further to fill the employee’s offer of health coverage details, the IRS requires you to complete a few basic information about you & your employees.

You will need the following information to complete Line 1-13 in Part I of

Form 1095-C.

- To complete Line 1 - 6 of Form 1095-C, you need the employee information such as Name, SSN, Street address, City, State, Zip Code

- To complete Line 7 - 13 of Form 1095-C, you need the employer information such as Name, SSN, Street address, City, State, Zip Code

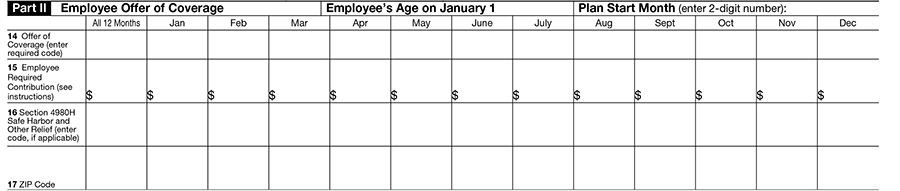

2. Instruction to complete Part II, Employee Offer of Coverage of Form 1095-C

The IRS has recently made some changes in Form 1095-C related to ICHRA plan. So, before entering into the lines, employers need to fill the employee’s age & plan start month.

- Age: If the employee was offered an ICHRA, enter the employee’s age on January 1, 2022.

- Plan Start Month: ALE must complete this box for the Form 1095–C. Enter the two-digit number (01 through 12) representing the calendar month during which the plan year begins of the health plan in which the employee is offered coverage

After completing these fields, employers must start entering the employee’s offer of coverage information

Line 14-17 is all about the employee offer of coverage.

Line 14

Offer of Coverage

This section of the form is where the ACA codes come into play. Line 14 is designed to collect information from the employer about their employee’s offer of coverage. In this line, employers need to indicate the employee’s coverage status for each month of the year by entering the appropriate code.

Indicator Codes for Employee Offer of Coverage (Form 1095-C, Line 14)

IRS designed the Code Series 1 indicator codes from 1A to 1U which represent the type of coverage, if any, offered to an employee, the employee’s spouse, and the employee’s dependents.

A code must be provided for each calendar month, January through December, even if the employee was not a full-time employee for one or more of the calendar months.

For instance, 1B represents that the employee was offered minimum essential coverage, but it was not extended to their spouse or dependants.

Click here to learn more about Form 1095-C Line 14 Codes.

Updates on Form 1095-C for 2024 Tax Year

In the month of October, the IRS has released the final version of Form 1095-C for 2024 tax year and it clearly indicates that there are no additions in codes or line in for 2025 ACA reporting.

Learn more about Form 1095-C Line 14 ICHRA Codes.

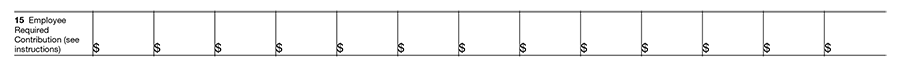

Line 15

Employee Required Contribution

The employer will need to indicate the Employee Required Contribution, which is the monthly premium that the employee was required to pay each month of the calendar year.

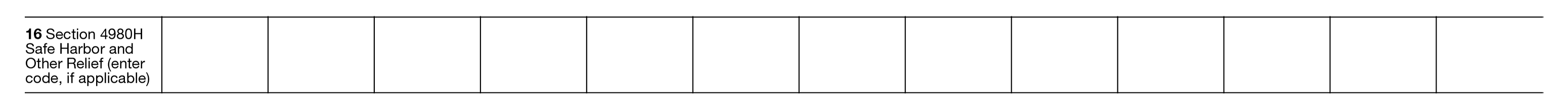

Line 16

Section 4980H Safe Harbor and Other Relief

Line 16 is for employers who have used Safe Harbors or alternative methods for calculating the affordability of their health insurance coverage.

Line 16 Codes of Form 1095-C, Safe Harbor

IRS designed the Code Series 2 indicator codes from 2A to 2I to determine affordability.

For example, if a 2H is entered, this indicates that the employer used the Rate of Pay Safe Harbor to determine the affordability.

Click here to learn more about ACA Form 1095-C Line 16 Codes.

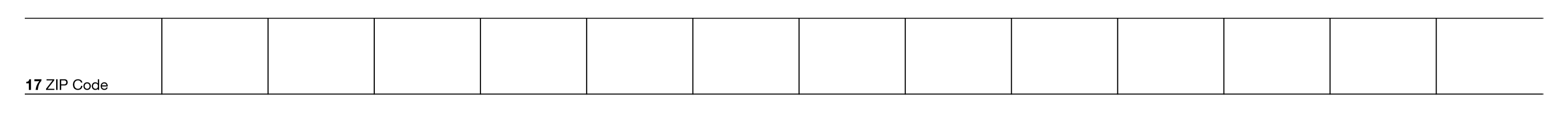

Line 17

ZIP Code

Line 17 is a new addition to Form 1095-C related to the ICHRA plan. Employers who offered ICHRA must now report the zip code of where their individual resides. This geographical information is used by the IRS to verify the plan’s affordability.

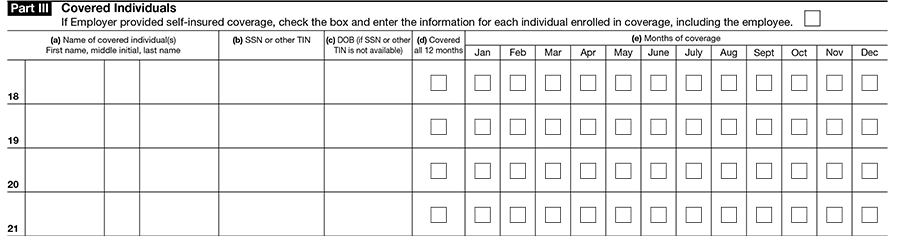

3. Instruction to complete Part III, Covered Individuals of Form 1095-C

After entering the offers of coverage details, you must start entering the individual coverage details.

Line 18-30 is all about the individual’s coverage details.

- In this section of Form 1095-C, the employer must indicate every covered individual by checking the boxes for every month of the year that they were covered. This includes coverage information for any spouses or dependents included in the health insurance coverage offer.

- Please note that if you are a self-insured employer, you only need to enter information related to the employees who were enrolled in the coverage.

Filing IRS Form 1095-C Electronically

As you can see, meeting the filing requirements for Form 1095-C is no easy feat, as this is a complex tax form.

However, there is no need to go it alone when it comes to your ACA reporting. Get Started with ACAwise, an IRS authorized provider that takes care of your e-filing of ACA Form 1094 and 1095 to the IRS.

We offer flexible services to help businesses like yours maintain their IRS compliance. Need ACA codes? We can generate them and e-file your forms with the IRS easily. We also offer a solution for printing and mailing your recipient copies as well. Learn more about our services here.

We simplify your ACA Form 1094 and 1095 reporting. Send us your requirements to [email protected] or contact us at (704)-954-8420. Know more about our services.

Let us take care of your ACA Reporting!

We file your 1094/1095 Forms with the IRS and postal mail the copies to employees before the deadline.

Browse By Topics

×- ACA Reporting Deadline

- 1095-C Code Sheet

- Form 1095-C Instructions

- Form 1095-B Instructions

- ACA Vendor Checklist

- 2020 ACA Penalties

- ACA Requirements

- Letter 5699

- Letter 226J

- 2020 Revised ACA Form

- Form 1095-C

- Form 1095-B

- ICHRA Affordability 2020

- Notice CP220J

- ACA Full-Time Employees

- Penalty Notice 972CG