ACA Form 1095-C Codes -

Line 14 (Offer of Coverage), and Line 16 (Section 4980H Safe Harbor) Codes Sheet

ACA Form 1095-C Codes Sheet - an Overview

- Updated November 08, 2024 - 8.00 AM by Admin, ACAwiseThe IRS requires ALEs to report their employee’s health coverage information on Form 1095-C.

To report the information, ALEs must be clear about the Offer of Coverage and Safe Harbor Codes that should be entered on the ACA Form 1095-C.

The IRS has designed two sets of codes to allow employers a way to describe their health coverage offers on each 1095-C Form. Each code indicates a different scenario regarding an offer of coverage, Section 4980H Safe Harbor Codes, and other relief for ALE Members.

Table of Contents:

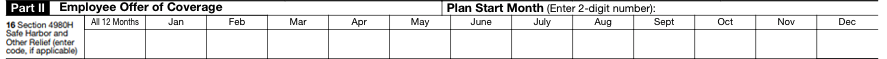

Form 1095-C Line 14 Codes, Offer of Coverage

Line 14 of Form 1095-C is used to report information about the coverage offered throughout the year.

Line 14 Codes are used to represent the following information.

- Whether the employees’ received an offer of coverage or not and

- What type of health coverage was offered.

- Which months that health coverage was offered

Line 14 Codes of Form 1095-C

The IRS has designed sets of codes from 1A to 1U to describe the offer of coverage.

Take a look at the table below to learn more about code series 1 to be reported on line 14 of Form 1095-C.

| Codes | Description |

|---|---|

| 1A |

It represents the qualifying offer offered to full-time employees. The Minimum Essential Coverage (MEC) providing Minimum Value (MV) offered to the full-time employees with employee's contribution was equal to or less than 9.5% mainland single federal poverty line. Also, it represents the contribution of at least minimum essential coverage offered to spouse and dependent(s). |

| 1B |

It represents the minimum essential coverage providing minimum value offered only to employees. But the coverage was not included for spouse or dependent(s). |

| 1C |

It indicates Minimum essential coverage providing minimum value offered to the employees. It also represents the offering at least minimum essential coverage to dependent(s), but not the spouse. |

| 1D |

It indicates Minimum essential coverage providing minimum value offered to the employees. It also represents the offering at least minimum essential coverage to Spouse but not the dependent(s). Use code 1J if the coverage for the spouse was offered conditionally. |

| 1E |

Use Code 1E, if minimum essential coverage provides minimum value offered to employees and at least minimum essential coverage offered to dependent(s) Use code 1K if the coverage for the spouse was offered conditionally. |

| 1F |

Use “Code 1F” Minimum essential coverage NOT providing minimum value offered to employees, employee and spouse or dependent(s), or employee, spouse, and dependents. |

| 1G |

Use code "1G", if you offer the coverage for at least one month to an individual who was not an employee for any month of the calendar year and the employees who enrolled for one or more months of the year in self-insured coverage. |

| 1H |

No health coverage or not offered minimum essential coverage to the employees, which may incorporate one or more months in which the individual was not an employee. |

| 1I |

Reserved. |

| 1J |

Use Code “1J” if Minimum essential coverage provides minimum value offered to employees and at least minimum essential coverage conditionally offered to a spouse, but not offered to dependent(s). |

| 1K |

Use Code “1K” Minimum essential coverage providing minimum value offered to employees; at least minimum essential coverage offered to dependent(s), and conditionally offered to spouse. |

| 1L |

Individual coverage health reimbursement arrangement (HRA) offered to the employee-only with affordability was determined using the employee's primary residence location ZIP Code. |

| 1M |

Individual coverage HRA offered to the employee and dependent(s) (not spouse) with affordability was determined using the employee's primary residence location ZIP Code. |

| 1N |

Individual coverage HRA offered to the employee, spouse, and dependent(s) with affordability was determined using the employee's primary residence location ZIP Code. |

| 1O |

Individual coverage HRA offered to the employee-only using the employee's primary work location ZIP Code affordability safe harbor. |

| 1P |

Individual coverage HRA offered to the employee and dependent(s) (not spouse) using the employee's primary work location ZIP Code affordability safe harbor. |

| 1Q |

Individual coverage HRA offered to the employee, spouse, and dependent(s) using the employee's primary work location ZIP Code affordability safe harbor. |

| 1R |

Individual coverage HRA that is NOT affordable offered to the employee; employee and spouse or dependent(s); or employee, spouse, and dependents. |

| 1S |

Individual coverage HRA offered to an employee who was not a full-time worker. |

| 1T |

The Individual coverage HRA offered to the employee and spouse (no dependents) and affordability was determined using the employee's primary residence location ZIP code. |

| 1U |

The Individual coverage HRA offered to the employee and spouse (no dependents) and affordability was determined using the employee's primary employment site ZIP code affordability safe harbor. |

Not sure about generating Line 14 ACA codes?

Send us your requirements to [email protected] or contact us at (704)-954-8420.

Let ACAwise take care of generating ACA Codes and e-file it with the IRS / State. We also handle reporting for special cases like ICHRA, COBRA coverage, age band, rehires, etc.

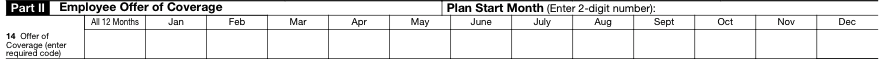

Line 16 Codes of Form 1095-C, Safe Harbor

Form 1095-C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer’s shared responsibility "Safe Harbor" provisions of Section 4980H.

The table below explains the code series 2 to be reported on line 16 of Form 1095-C.

| Codes | Description |

|---|---|

| 2A |

Use Code 2A, if the employee was not employed on any day of the Do not use code 2A for a month if an employee of the ALE worked for any day of the calendar month and an employee terminates employment with the |

| 2B |

Use code 2B if the employee is not a full-time employee and did not enroll in minimum essential coverage, if offered for the month. Also If the employee terminated their employment before the end of the month but did enroll in coverage use code 2B. |

| 2C |

Use code 2C if an ALE Member offered health coverage to the employees for each day Do not use this code for the following scenarios:

|

| 2D |

Use code 2D, if an employee is in a section 4980H(b) Limited Non-Assessment Period for any month. |

| 2E |

In which the multiemployer arrangement interim guidance applies for that employee for any month, despite whether any other code in Code Series 2 might also apply. |

| 2F |

Use Code 2F if an ALE member applies the section 4980H Form W-2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee |

| 2G |

Use code 2G if the ALE Member uses section 4980H federal poverty line safe harbor to find affordability for purposes of section 4980H(b) for any month. |

| 2H |

Use code 2H if the ALE Member used the section 4980H rate of pay safe harbor to determine affordability for purposes of section 4980H(b) for any month. |

| 2I |

Reserved. |

Let ACAwise handle your

ACA Reporting.Provide your payroll, benefits, and employee census data using our ACAwise template or your own template.

We take care of everything for you!

- 1. ACAwise will generate the Line 14 & 16 1095-C Codes accurately.

- 2. ACAwise will e-file 1094/1095 Forms with the IRS.

- 3. ACAwise will distribute the copies to your recipients.

Need help in generating Line 14 and 16 ACA Form

1095-C Codes?

Get Started with ACAwise, a cloud-based solution that provides a ACA Elite to all types of businesses across many different industries. We handle all the types of scenarios, including ICHRA, rehires, cobra coverage, dependent age band, etc.

Provide us with your payroll, health benefits, and employee census data through our ACAwise template or your own template.

ACAwise will handle

- ACA Form 1095-C Codes (Line 14, & 16) Generation

- Form 1094-B/C and 1095-B/C Generation

- IRS E-Filing through IRS AIR System

- State E-filing

- Postal Mailing of Employee Copies

If you have any queries about our ACA Reporting service, contact us at (704)-954-8420 or email to [email protected].

A Quick Guide for Employers

ACAwise has created a Free guide to help applicable large employers to know 2025 ACA Reporting Requirements

and ACA Codes better.