What Employers Should Know about IRS Form 1095-C?

In this article we will cover the following points:

- An overview of Form 1095-C

- The deadline for filing Form 1095-C

- How To file Form 1095-C

- The Benefits of Choosing ACAwise to meet your IRS Form 1095-C Deadline

ACAwise, a customized ACA Reporting solution, generates ACA Forms with Line 14, 16 codes and e-files them with the IRS / State and distributes employee copies. Learn More

Form 1095-C - An Overview

- Updated November 08, 2024 - 4.00 PM by Admin, ACAwiseWhen the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employees.

Under IRC Section 6056, the IRS requires ALEs to file ACA Forms 1095-C and distribute copies of ACA Forms to employees.

The following instructions summarize what employers must know about the ACA Form 1094-C and Form 1095-C filing requirements.

Table Of Contents:

- What is the purpose of Form 1095-C?

- Who must file Form 1095-C?

- Information required to file Form 1095-C

- Updates to 2025 Form 1095-C Filing

- What is the deadline to file Form 1095-C?

- How do I file an extension of time to file Form 1095-C?

- What is the penalty for failure to file or furnish Form 1095-C?

- How to file Form 1095-C?

- Where do I mail Form 1095-C?

- Meeting your 2025 Form 1095-C Reporting Requirements

What is the purpose of Form 1095-C?

Form 1095-C, Employer-Provided Health Insurance Offer and Coverage is used by applicable large employers (Employers with 50+ full-time equivalent employees) to report their employees’ health coverage information with the IRS.

The IRS uses the information on Form 1095-C to determine the following:

- Whether an employer is potentially liable for payment under the employer-shared responsibility provisions of section 4980H and the amount of the payment, if any.

- Eligibility of employees to purchase a premium tax credit.

Who must file Form 1095-C?

As mentioned earlier, Form 1095-C is filed by ALEs. This includes,

- Self-insured employers who have more than 50 employees - should complete all the parts of IRS Form 1095-C.

- Fully Insured employers who have more than 50 employees - should complete parts I and II of IRS Form 1095-C.

Information required to file Form 1095-C

The following information is required when filing ACA Form 1095-C

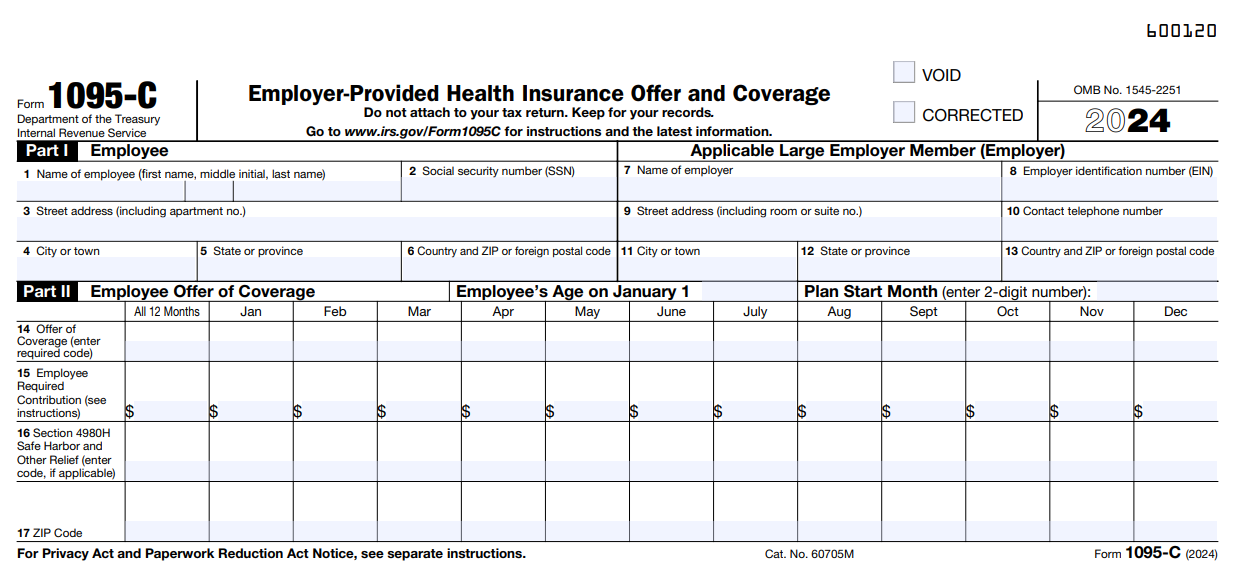

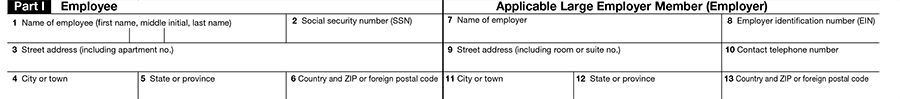

Part I, Employee and Applicable Large Employer

- Employee’s Basic Information such as Name, SSN, Address

- Employer’s Basic Information such as Name, EIN, Address

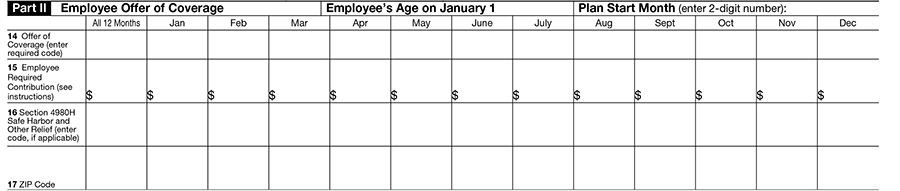

Part II, Employee Offer of Coverage

- Plan Start Month, Age

- Indicator codes for Offer of coverage

- Safe Harbor Codes to identify whether the coverage is affordable

Click here to learn more about Offer of coverage & Safe Harbor Codes.

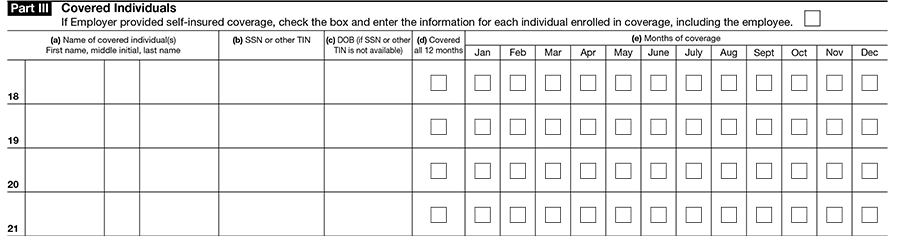

Part III, Covered Individuals

-

Employers who provided self-insured coverage must only complete Part III for employees who enrolled in the self-insured coverage

- Covered individuals details such as Name, SSN, month of coverage offered

Click here to know more about Form 1095-C filing instructions.

Updates to 2025 Form 1095-C Filing

The IRS has released a final version of the Form 1095-B and 1095-C for 2024 ACA reporting in the month of October, which clearly indicates that there are no changes or additions to the 1095 codes.

While there were no major changes to ACA forms and their respective ACA codes during the tax year, the IRS did update the ACA affordability percentage for the 2024 tax year.

- The affordability percentage for the 2024 tax year is 8.39%.

- The IRS reduces the e-filing threshold to 10 returns. i.e., if you are filing 10 or more returns, it is mandatory to e-file them.

- Also, the IRS has increased the penalty amount for employers and health coverage providers who fail to complete their ACA reporting on time. Check out the updated penalty amounts.

What is the deadline to file Form 1095-C?

An ALE should furnish an ACA Form 1095-C to each of its full-time employees by March 03, 2025, for the 2024 calendar year.

An ALE should file ACA Forms 1094-C and 1095-C by March 31, 2025, if you choose to file electronically, and the Form should file by February 28, 2025, if filing on paper.

To learn more about IRS and State filing deadlines, click here.

How do I file an extension of time to file Form 1095-C?

Employers can file Form 8809 with the IRS for an automatic 30-day extension of time to file their 1095-C forms.

The extension form may be submitted on paper or electronically. No signature or explanation is required for the extension.

The Form 8809 extension must be filed on or before the 1095-C filing deadline, otherwise the employer is not eligible for a 30-day extension.

Penalties for failure to file or furnish Forms 1095-C

The penalty for filing & furnishing ACA Forms with an incorrect ACA information return is $280 for each return for which the failure occurs, with the total penalty for a calendar year not exceeding $3,392,000.

Click here to learn more ACA penalties.

Relief Regarding Form 1095-C

As for IRS Form 1095-C, the IRS will not impose a penalty for failure to furnish it in regards to any employee that is enrolled in an ALE member’s self-insured health plan who is not a full-time employee for any month of 2020. Employers must meet this condition by completing Part 1 of the Form 1095-C and indicating Code 1G for this employee in the IRS reporting. See Notice 2020-76 for more information on reporting penalties.

Remember, The 2020 section 6055 furnishing relief in no way affects the assessment of penalties associated with the filing requirement or the deadline to file with the IRS the 2020 Forms 1094-C or 1095-C,

as applicable.

The IRS imposes penalties for failure to file current information returns on time and provide correct payee statements. If the penalty amount isn’t paid in full, they can accrue monthly interest as well.

- ACA penalty rate for the 2024 tax year under the Section 4980H(a) is, $2,970

- ACA penalty rate for the 2024 tax year under the Section 4980H(b) is, $4,660

Check out our ACA Penalty Calculator for a closer look at the potential penalty amounts for late filing.

If an employer or a coverage provider fails to file ACA Forms or furnish recipient copies on time or files with incorrect information, the IRS imposes penalties under sections 6721 and 6722 to ALEs.

The IRS revised penalty rates for failing to comply with failure to file or furnish ACA forms under sections 6721 and 6722.

How to file Form 1095-C?

Employers can file their ACA Forms 1095-C electronically or submit paper copies to the IRS. However, if the employer is filing 250 or more forms, they are required to e-file.

Regardless of the size of the organization, the IRS prefers that employers file electronically. This allows the IRS to process the forms at a faster rate and provide status updates for the forms.

In conclusion, electronic filing is the most accurate and secure filing method. E-file IRS Form 1095-C Now.

However, If you choose to paper file the ACA Form 1095-C, download the IRS Form 1095-C, fill in the necessary details and then send it to the IRS by the address mentioned below.

Note: The IRS has imposed new e-filing requirements for 2024. Businesses filing 10 or more Forms 1095 (or any other tax return) will be required to e-file. This will affect filing for the 2023 tax year. Get Started Now

Where do I mail Form 1095-C?

If you choose to file paper copies of ACA Forms 1095-C, you should submit them to the IRS using the mailing addresses listed below. The mailing address is generally based on the location of the business.

| Business Location | Mailing Address |

|---|---|

| Alabama, Arizona, Arkansas, Connecticut, Delaware, Florida, Georgia, Kentucky, Louisiana, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, West Virginia |

Department of the Treasury Internal Revenue Service Center Austin, TX 73301 |

| Alaska, California, Colorado, District of Columbia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maryland, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming |

Department of the Treasury Internal Revenue Service Center P.O. Box 219256 Kansas City, MO 64121-9256 |

Meeting your 2024 Form 1095-C Reporting Requirements

If you need a complete solution for meeting your organization’s ACA Form 1095 filing requirements, choosing an ACA reporting vendor is ideal.

ACAwise is an ACA reporting solution that provides a full-service option for meeting your ACA reporting requirements.

ACAwise’s end-to-end solution allows you to e-file your ACA Form 1095-C with the IRS and required state(s) as well as distribute employee copies. ACAwise’s team of experts has experience with special reporting scenarios, including ICHRA, COBRA, rehires, terminations, and more.

ACAwise helps to e-file your ACA Form 1095-C with the IRS, State and distribute the 1095 copies to your employees on-time. ACAwise is equipped to handle special scenarios such as ICHRA, COBRA, Rehire, terminated, etc.

We provide two different reporting services for you to choose from, based upon your requirements.

Interested in ACAwise?

Send us your requirements to [email protected] or give us a call at (704)-954-8420.

You can Sign Up Now and add your basic business details to begin your ACA Reporting.

One of our ACA Representatives will contact you with a free consultation and quote.

Article Sources:

A Quick Guide for Employers

ACAwise has created a Free guide to help applicable large employers to know 2025 ACA Reporting Requirements

and ACA Codes better.