IRS issues Letter 5699 to the Employers for

Non-Compliant with

ACA Reporting

This article further explores the

following points:

- IRS Letter 5699 Explained

- ACAwise helps you to respond to the Letter 5699 on time

Letter 5699 - An Overview

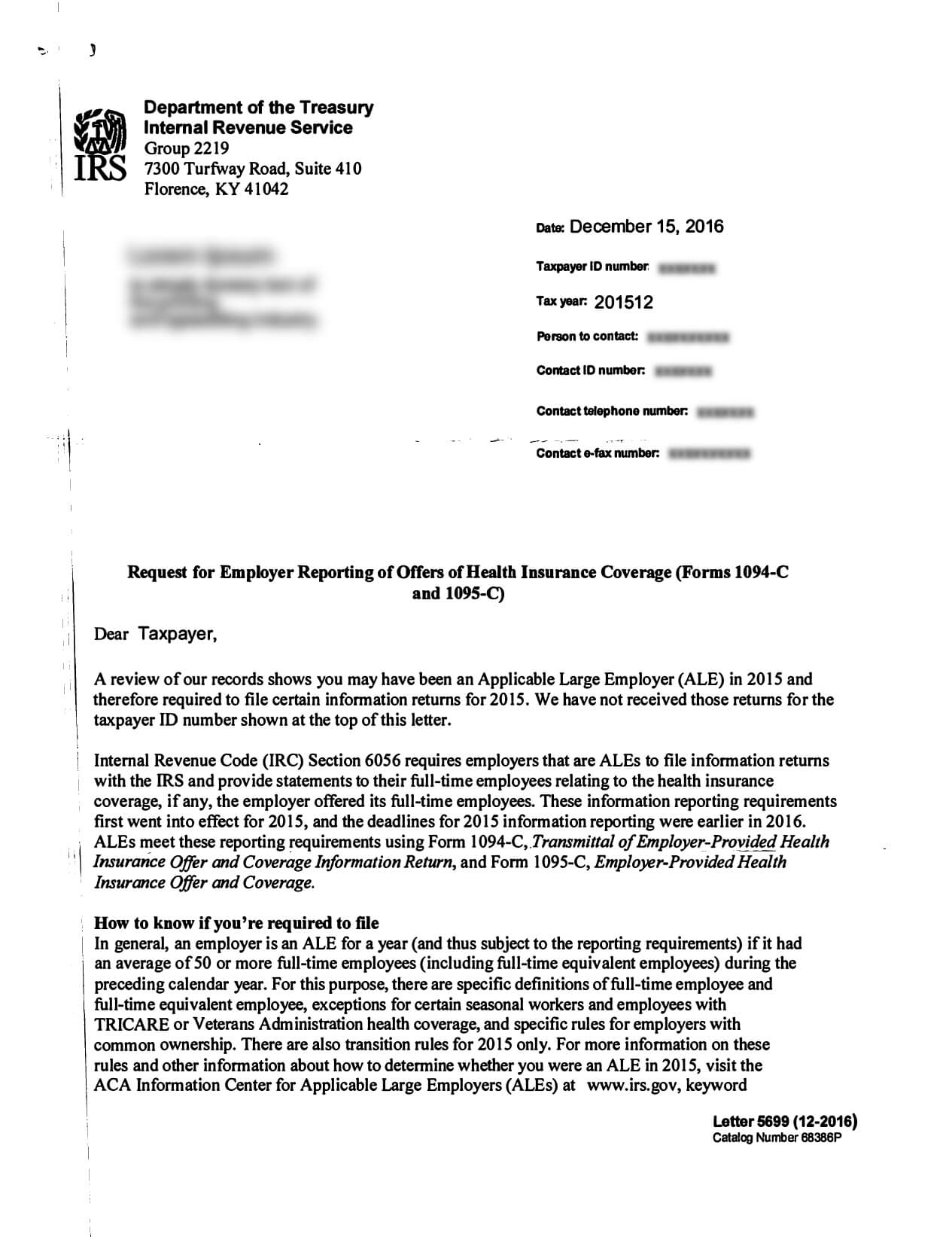

- Updated November 08, 2024 - 8.00 AM - Admin, ACAwiseIRS will initially send the Letter 5699 to Applicable Large Employers who have not met the ACA Reporting Requirements under IRC section 6056.

IRS Letter 5699 Explained.

Letter 5699 is issued by the IRS to inquire ALEs for the missing information and the reason for not being compliant with the ACA Reporting under section 6056.

IRS identifies the noncompliant ALEs based on their W-2 forms reported for the calendar year.

The letter 5699 contains the following basic information:

- The date the letter was sent

- The taxpayer ID number

- The tax year(s) in question

- An IRS person to contact with

any questions - A contact telephone number

- A contact e-fax number

What you must do when you receive the letter 5699 from the IRS?

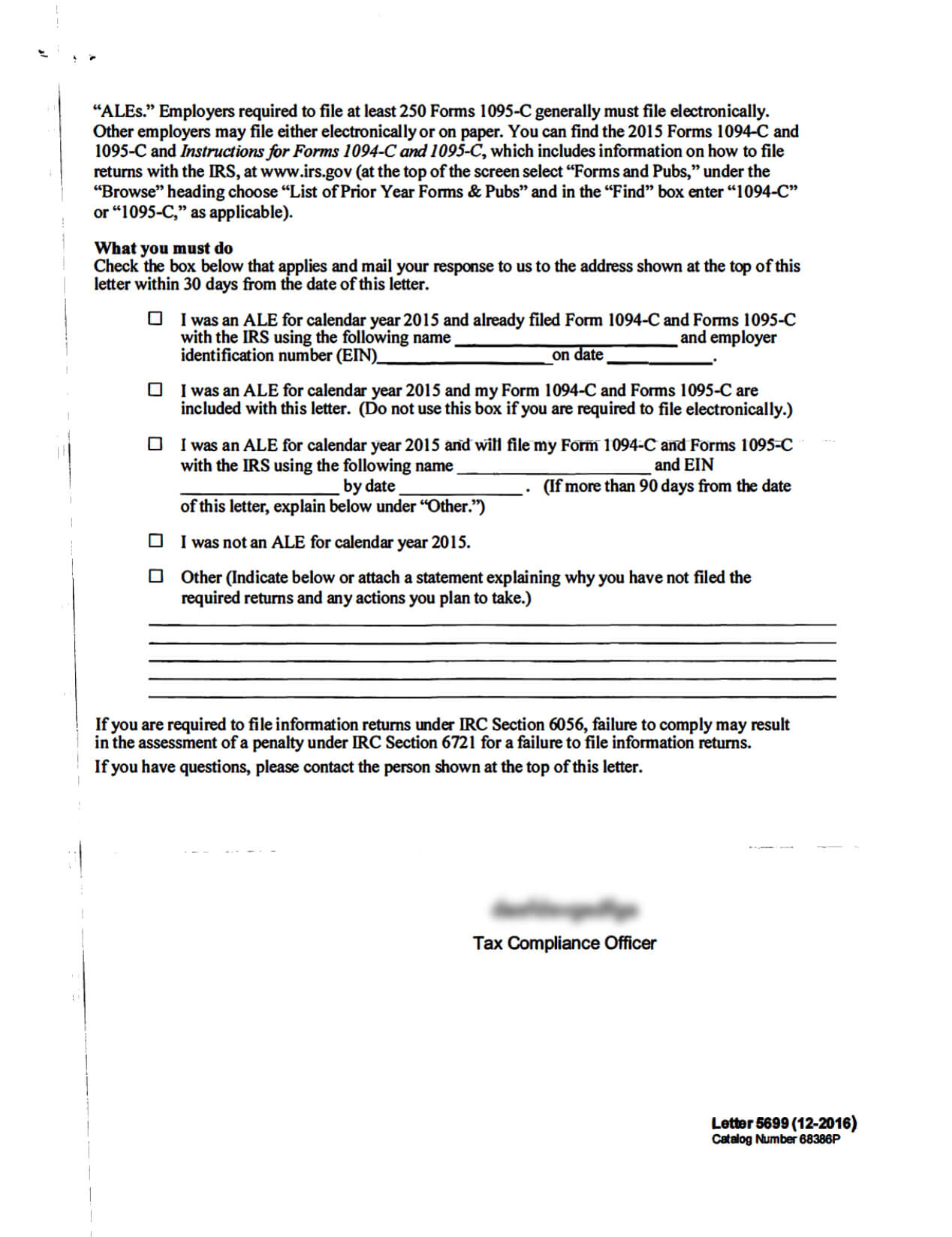

Letter 5699 will have five options listed below and you must respond to one of the options which are applicable to you within 30 days.

Choose this option, if you were an ALE for the calendar year and already filed Form 1094-C and Form 1095-C with the IRS.

I was an ALE for calendar year and already filed Form 1094-C and Forms 1095-C with the IRS using the following name _____________ and employer identification number (EIN) __________ on date ________

Choose this option if you were an ALE for the calendar year and planning to include your Form 1094-C and 1095-C with this letter.

I was an ALE for the calendar year and have included my Form 1094-C and Forms 1095-C with this letter. (Do not use this box if you are required to file electronically.) (Explain reasons for late filing below under “Other”)

Choose this option, If you are yet to file and provide the other required details. In case, if you need time more than 90 days, explain the reason under the option “Other"

I was an ALE for the calendar year and will file my Form 1094-C and 1095-C with the IRS using the following name __________ and EIN __________ by date ______ (If more than 90 days from the date of this letter, explain below under “Other”) (Explain reasons for late filing below under “Other”)

If you are not an ALE for the calendar year, Choose this option and explain the reason under the option “Other”

I was not an ALE for the calendar year. Explain reasons below under “Other”.

Choose this option to explain why you haven’t yet filed your return and what action you are planning to take.

Other (Indicate below or attach a statement explaining why you haven’t filed the required returns and any action you plan to take.)

What happens if you fail to Respond to IRS

Letter 5699?

| Penalty type | For Small Business | For Large Business | ||

|---|---|---|---|---|

| Per return | Maximum penalty | Per return | Maximum penalty | |

| Corrected within 30 days | $60 | $232,500 per year | $60 | $664,500 per year |

| Corrected after 30 days, but before Aug. 1 | $130 | $664,500 per year | $130 | $1,993,500 per year |

| Corrected after Aug. 1 |

$330 | $1,329,000 per year | $330 | $3,987,000 per year |

In such a case, the ALEs must act quickly upon the Letter 5699 issued by the IRS to avoid the

large penalties.

Received IRS Letter 5699? ACAwise is here to assist you!

ACAwise helps you to respond to the Letter 5699 on time. If you have any queries in the Letter 5699, contact ACAwise at (704)-954-8420 or email your concern with the Letter you received to [email protected]. Don't delay further, because you have to respond to the IRS within 30 days from the date you receive this letter.

We have a team of experts who are ready to save you from paying millions of

unnecessary penalties.

A Quick Guide for Employers

ACAwise has created a Free guide to help applicable large employers to know 2025 ACA Reporting Requirements

and ACA Codes better.

"

"