Solutions to Meet the Needs of the Largest Union in the U.S

ACAwise was able to provide a complete reporting solution for a large union with 12,000+ employees and help them comply with their IRS requirements under IRS Section 6055.

Chipping Away ACA Reporting Barriers

When the Affordable Care Act (ACA) was passed, the IRS designed Section 6055, which requires any person/organization that provides minimum essential coverage during a given calendar year to report the health coverage information to the IRS and furnish copies to all covered individuals.

As a result, every year, the Union faced difficulties handling ACA filings efficiently and on time with the IRS because it has multiple group organizations operating under 4 different EINs.

The Union provides health coverage to its retirees and their dependents. This requires them to report the health coverage information to the IRS using Forms 1095-B to comply with the ACA requirements under COBRA.

It has been a challenge for this organization to handle the reporting process for such a large number of retired employees, especially given the amount of information required to complete the filing process.

To solve this problem, this union reached out to ACAwise in search of a full-service solution for meeting their year-end 1095-B reporting requirements. In addition to meeting the IRS requirements under Section 6055, the organization also needed a solution for meeting its state-mandated reporting requirements.

One of this organization’s biggest concerns was the security of their employees’ personal data.

Meeting ACA Reporting Requirements with Accurate Data and On-Time Filing

Based on the Union’s specific challenges and requirements, ACAwise devised a solution for ACA reporting complete with a clear timeline and plan to execute it. Creating and following this customized reporting plan allowed ACAwise to carry out their ACA filing securely and accurately.

Data Handling and Form Generation

Since the Union operates under multiple EINs, ACAwise offers a secure portal for the representatives of each entity to upload their employees' data and health coverage information into the ACAwise system using their own template. Once the data has been imported by the representative of each entity, ACAwise begins the progress of the ACA filings.

First, ACAwise extracts the health coverage information provided by each entity and converts it into the ACAwise system format.

ACAwise also performs data integrity checks to identify any missing or incorrect data and to correct basic errors during the initial process.

Data Validation and Form Review

After completing the basic validation process, ACAwise proactively carries out an in-depth auditing process, where each employee’s data are validated against IRS XML schemas and business rules, ensuring all the information was accurate to generate the forms.

Furthermore, ACAwise also performs pre-validation steps, such as TIN mismatch reporting and USPS address validation, to reduce rejection rates post-filing with the IRS and ensure that mailing copies are delivered to the recipient’s correct address without delay.

After the complete data validation process, ACAwise began to generate the 1095-B copies for each employee based on the information provided by the Union and share that to the unions’ team representatives for review through the secure portal.

ACAwise allows the Union to notify the errors, if there are any, to the ACAwise team. From there, the compliance team of ACAwise fixes the errors notified by the Union and shares it again with them for review and approval.

IRS ACA Compliance

After the Union’s approval, ACAwise transmits the generated 1094 and 1095 Forms to the IRS via the IRS AIR system and distributes the 1095 copies via postal mail to the employees on-time.

Upon processing returns with the IRS, ACAwise also e-file 1094 / 1095 Forms with the State that mandated individual health care reporting.

As a result, the Union has adequate visibility and tracking to ensure accurate e-filing with the IRS & State and postal distribution of recipient copies to its employees before the deadline.

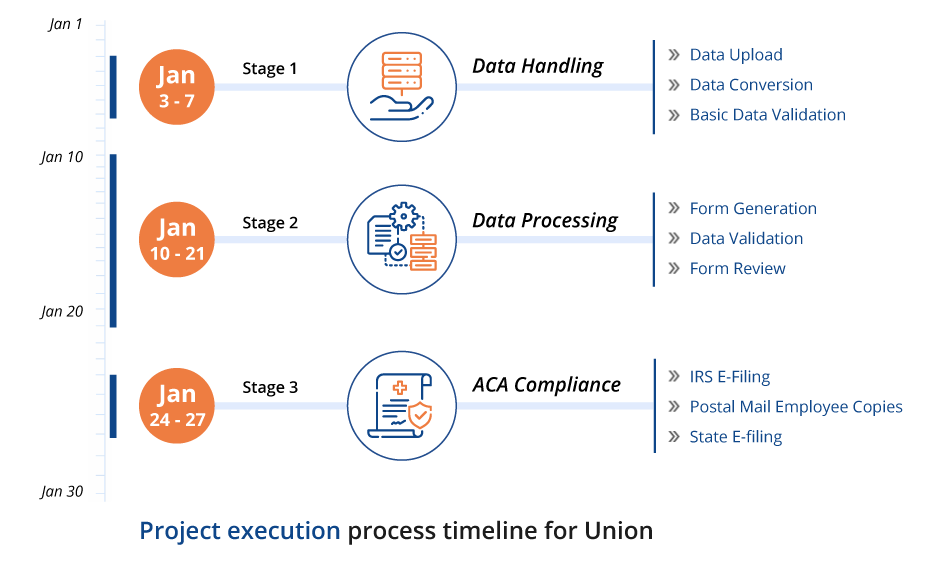

Project Execution by ACAwise for Unions

No matter how challenging it might be. ACAwise believes transparency creates trust in our work process.

So, here’s our detailed project execution plan that tells how our team planned and collaborated with the Union right from the start of a project to e-filing Form 1094/1095-B with the IRS.

Finally, the expert team of ACAwise made the Union’s ACA filing season a success and they are now truly pleased and satisfied with the ACAwise process.