ACA Reporting Requirements for Employers

IRS ACA Reporting Requirements - An Overview

- Updated December 19, 2025 - 8.00 AM by Admin, ACAwiseAffordable Care Act (ACA) reporting is one of the major requirements that employers and health coverage providers should fulfill in order to remain compliant with the IRS under sections 6055 and 6056.

In this article, you can find out the requirements for reporting ACA Forms, 2026 reporting deadlines, and more.

Table of Contents

- ACA Reporting Requirements Under Section 6055

- ACA Reporting Requirements Under Section 6056

- Recent changes made to ACA Reporting Requirements

- ACA 1094 and 1095-B/C Reporting Deadlines for 2025 Tax Year

- Information Required for 2025 Tax Year ACA 1095 Reporting

- State-Level ACA Reporting Requirements

- Penalties for Failing to Meet ACA Reporting Requirements

- Meet Your 2025 Tax Year ACA Reporting Requirements Efficiently with ACAwise!

ACA Reporting Requirements Under Section 6055

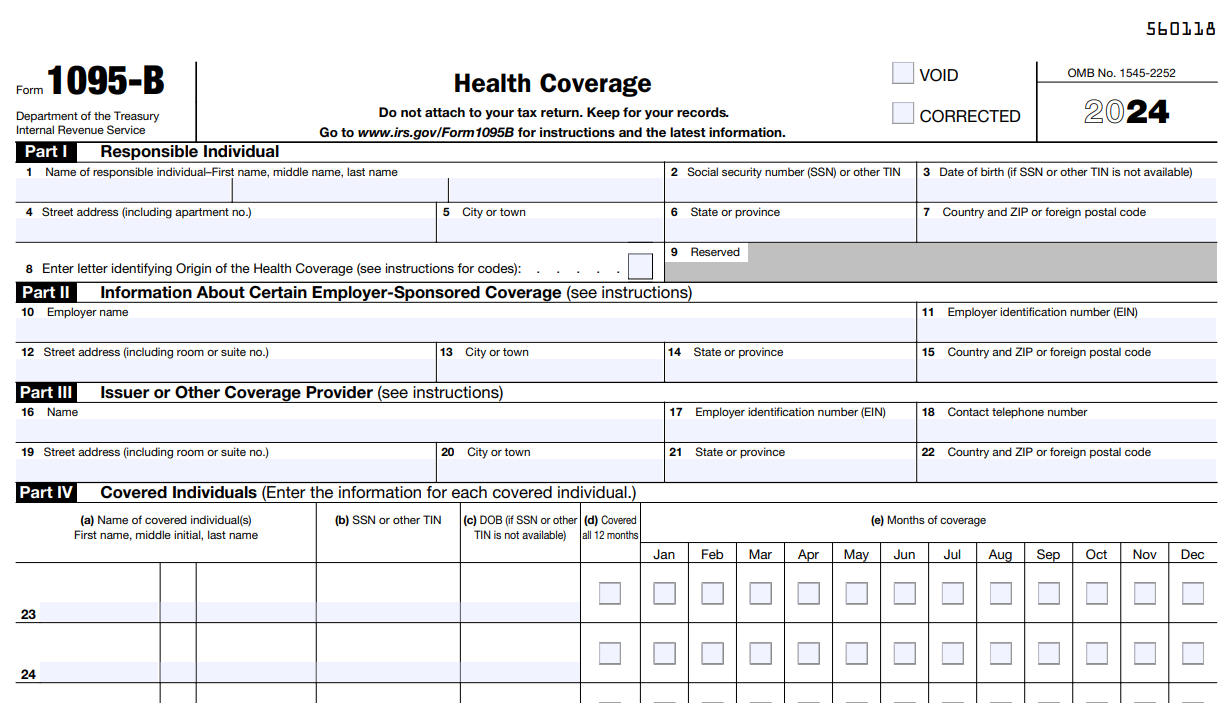

- The IRS Section 6055 states that anyone who provides Minimum Essential Coverage (MEC) to any individual must report details regarding the coverage to the IRS by filing Form 1095-B along with the transmittal Form 1094-B.

- The information reported on Form 1095-B is used by the IRS to administer the individual shared responsibility provision of the ACA. This provision requires most individuals to have health insurance or pay a penalty.

This requirement is applicable to,

- Small employers (less than 50 full-time employees) that sponsor self-insured health coverage.

- Employers that offer employer-sponsored self-insured health coverage to nonemployees who enroll in the coverage may use Form 1095-B.

- Health insurance issuers or carriers

- Governmental units that offer health coverage under a government-sponsored program.

What is Minimum Essential Coverage?

Minimum essential coverage includes government-sponsored programs, eligible employer-sponsored plans, individual market plans, and other coverage of the Department of Health and Human Services designated as minimum essential coverage.

ACA Reporting Requirements Under Section 6056

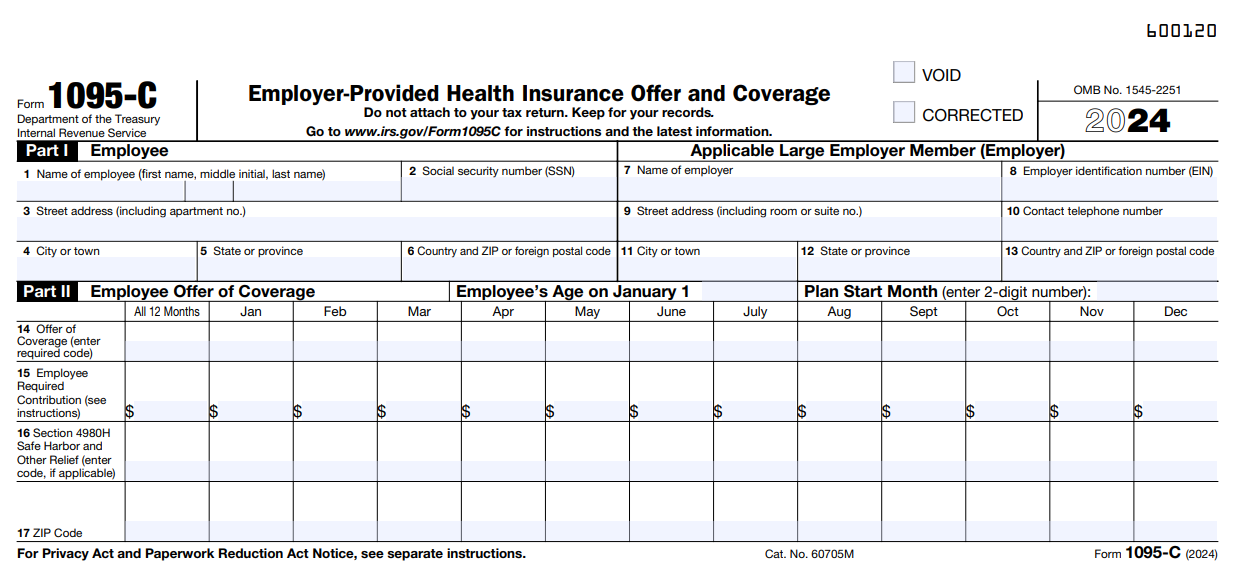

- Under the Employer Shared Responsibility Provisions (Employer Mandate), the Applicable Large Employers (ALE), i.e., employers with 50 or more full-time employees, must provide MEC to their employees.

- Section 6056 requires the ALEs to report the health coverage information of their employees by filing Form 1095-C and the transmittal Form 1094-C. They must distribute a copy of these forms to the respective employees.

This requirement is applicable to,

- Employers with an average of at least 50 full-time employees (including full-time equivalent employees) on business days during the preceding calendar year.

- Employers that are members of an aggregated ALE group, which is a group of related employers that are treated as a single employer for purposes of the ACA.

Recent changes made to ACA Reporting Requirements

for 2025 Tax Year

On October 2025, the IRS released the final instructions for ACA forms, which state that there are certain changes made to the ACA deadline, penalties, and the codes for the tax year 2025.

1. Revised Deadline for Recipient Copy Distribution

According to the updated IRS instructions, eligible ALE Members offering self-insured coverage to non-full-time employees and nonemployees and meeting Reg. §1.6055-1(g) may use the alternative manner of furnishing statements instead of automatically sending Forms 1095-C and 1095-B. Under this requirement, the employer is required to post a clear and easily accessible notice on its website informing individuals that they may request a copy of their statement. Instead, the employer must:

- Post a clear and accessible notice on their website telling individuals they can request a copy of their statement, and

- When requested, the statement must be sent by the later of January 31, 2026, or 30 days from the date of the request.

2. Updated ICHRA Affordability Percentage:

The IRS has adjusted the ACA affordability percentage for the 2025 tax year to 9.02%, based on the federal poverty line percentage.

3. Revised Penalty rates:

There are some notable changes in the ACA penalty rates:

- Under Section 4980H(a) – the penalty rate is $2,900 for the tax year 2025.

- Under Section 4980H(b) – the penalty rate is $4,350 for the tax year 2025.

ACA 1094 and 1095-B/C Reporting Deadlines for 2025 Tax Year

The IRS has adjusted ACA reporting deadlines for tax year 2025 due to holidays. To stay compliant, ensure recipient copies are provided, and forms are filed on time through electronic filing or by paper. Avoid penalties by submitting accurate and timely reports to meet IRS standards.

To learn more about the ACA deadline for the 2025 tax year, click here.

Click here to know more about the State filing deadlines.

To meet the recipient copy and IRS / State e-filing deadline, get started with ACAwise. Send us your requirements to [email protected] or contact us at (704)-954-8420. Know more about our services.

Information Required for 2025 Tax Year ACA 1095 Reporting

The employers and health coverage providers are required to report details regarding the coverage they offer to the employees and individuals, respectively. Here is the summary of the information required to complete the ACA reporting,

- Basic information of the employer or the health coverage provider, such as Name, EIN and Address.

- Basic details of the employee or individual, such as Name, EIN and Address.

-

Details regarding the health coverage offered, such as Months of coverage.

(1095-C Codes) - Basic information about the individuals covered, if applicable (Name, SSN or DOB, and months covered)

ACA Form 1095-C Codes

The ALEs that file Form 1095-C are required to indicate the type of coverage offered, the employment status of the employee, and certain other details through a set of 1095-C codes on Lines 14 and 16. Learn More

State-Level ACA Reporting Requirements

Apart from the federal ACA reporting, there are states that mandate employers and health care providers to complete a separate ACA reporting with the state agencies.

The states include,

Learn more about ACA Reporting with the state.

Note: The deadlines for state-level ACA reporting may vary from state to state. Check out the ACA Deadlines

for the states

Penalties for Failing to Meet ACA Reporting Requirements

Every year, the IRS updates the inflation-adjusted amounts that will be imposed against any Applicable Large Employer (ALE) member who falls into one of the following categories:

- Under Section 4980H (a), a penalty will be levied on an employer who fails to provide group health coverage to a minimum of 95 percent of its full-time employees.

- Under Section 4980H (b), When an employer offers coverage to their employees that is either unaffordable or does not meet the minimum value standards set by the Affordable Care Act.

Learn more about ACA Penalties.

Meet Your ACA Reporting Requirements Efficiently with ACAwise for the 2025 Tax Year.

ACAwise is a comprehensive full-service ACA reporting solution provider that takes all the hassles and complexities out of your ACA reporting process.

- ACAwise offers you 2 different services,

- ACAwise also takes care of reporting your ACA Forms to the State.

- We will also take care of distributing the form copies to the recipients via Postal Mailing and Online Access.

See how ACAwise simplified ACA reporting for our Clients

Interested in ACAwise?

Provide us with your requirements and request a free quote. Our team of experts will reach out to you.

A Quick Guide for Employers

ACAwise has created a free guide to help applicable large employers to know the ACA Reporting Requirements better.