Massachusetts Form MA 1099-HC Reporting Requirements

Unlike other States, Massachusetts requires employers to file the State-specific Form MA 1099-HC for health coverage reporting.

ACAwise, the trusted source for ACA reporting also takes care of your

MA Form 1099-HC Filing. Get started today or send us your requirements to [email protected] or contact us on

(704)-954-8420.

Massachusetts Individual Mandate and ACA Reporting Requirements - An Overview

- Updated December 19, 2025 - 8.00 AM by Admin, ACAwise

After eliminating federal individual mandates under the Affordable Care Act (ACA) by Congress, Massachusetts state has implemented the individual mandate at the

state level.

The Individual mandate (Massachusetts Health Reform Law) effective from January 1, 2006, requires Massachusetts residents over the age of 18 to acquire Minimum Creditable Coverage (MCC).

The Minimum Creditable Coverage (MCC) is the minimum level of benefits that each resident must have, as defined by the state of Massachusetts (MA) to be considered insured and to avoid the penalty under the state’s individual mandate law. These penalties can add up for each month until the residents comply with the State’s mandate reporting requirements.

These instructions will help employers better understand their Massachusetts Individual Mandates Form MA 1099-HC Reporting Requirements.

Employer Responsibility for Massachusetts Individual Mandates

Employers who provide MCC to MA residents must submit the health coverage documents to the state, indicating that they meet Minimum Creditable Coverage (MCC).

They must also distribute copies to employees (residents of Massachusetts) so that they can complete their individual tax returns.

What Form To File on Form MA 1099-HC?

Employers must file Form MA 1099-HC to the state and distribute copies to employees (residents of Massachusetts).

- For employers with fully insured plans, most insurance carriers will submit forms MA 1099-HC to report minimum creditable coverage to the state and distribute copies to the employees on behalf of the employers. If their insurance carrier fails to file, employers are responsible for fulfilling these obligations to avoid penalties.

- For employers with self-insured plans, the employer is responsible for submitting Form MA 1099-HC to report their minimum creditable coverage to the state and distributing copies of the form to their employees.

When to File Form MA 1099-HC?

Feb 02nd

Feb 02nd

The deadline to distribute copies of MA 1099-HC to employees:

February 02, 2026 - Employers can download the draft copies of MA 1099-HC forms from the DOR website to distribute it to employees (primary subscriber) on or before the deadline.

Feb 02nd

Feb 02nd

The deadline to submit MA 1099-HC forms to the State:

February 02, 2026 - Employers must submit the Form MA 1099-HC to the Department of Revenue (DOR) electronically in a properly formatted XML file through MassTaxConnect on or before the deadline.

Note: If you’re an employer using the alternate method of furnishing statements, your deadline is January 31, 2026, or 30 days after the request, whichever is later. Learn more

To meet the recipient copy and IRS / State e-filing deadline, get started with ACAwise. Send us your requirements to [email protected] or contact us at (704)-954-8420. Know more about our services.

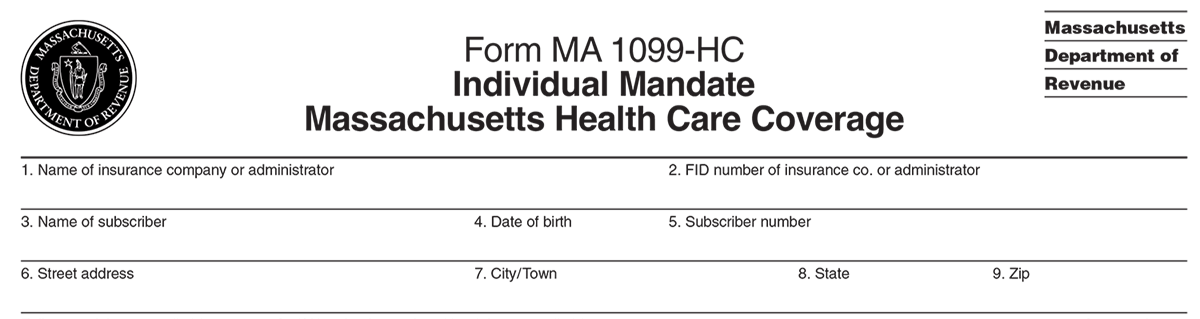

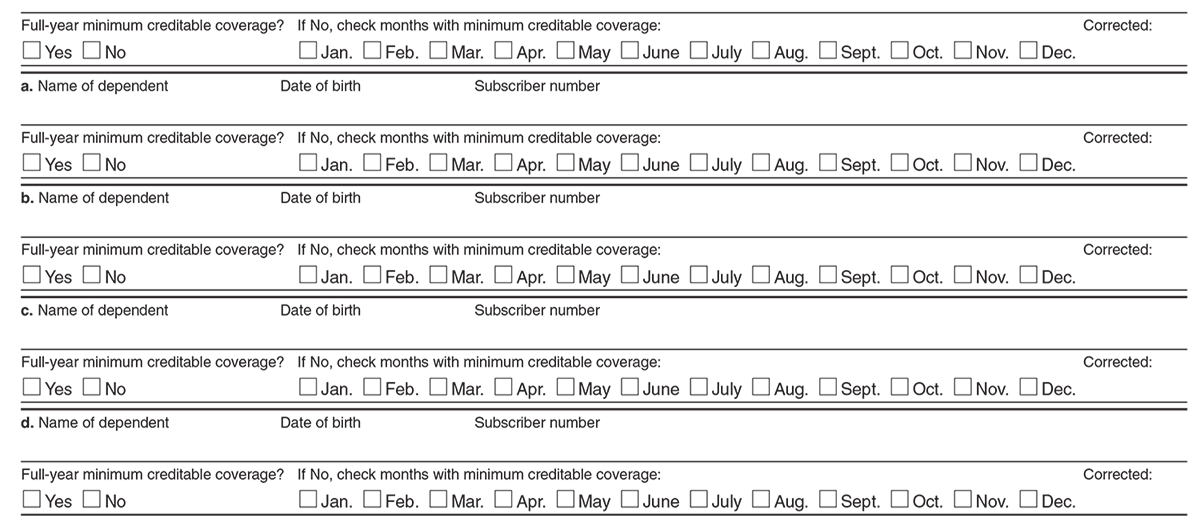

What Information to Report on Form MA 1099-HC?

To file MA 1099-HC forms with the State of Massachusetts (MA) and distribute copies to the residents of Massachusetts, the employer must need

the following:

- 1. Name, FID (Federal Tax ID) of the responsible insurance company or administrator.

- 2.Information on the primary subscriber, including Name, Subscriber number, Date of Birth (DOB), and Address.

-

3.The coverage period when the MCC was offered to the subscriber and their dependents.

- If the employee was covered for all 12 months of the year, the box indicating the same must be checked.

- If the employee was not covered for all 12 months of the year, the box against the months the MCC was offered must be checked.

Penalties for MA Form 1099-HC

Employers who fail to issue MA 1099-HC forms to the employees( residents of Massachusetts) will be subject to a $50 penalty per individual, going up to a maximum of $50,000.

Meet Massachusetts Form MA

1099-HC Reporting

ACAwise is a comprehensive ACA reporting solution that completely takes care of Massachusetts Form MA 1099-HC reporting

for employers.

With extensive experience in handling the e-filing of both the federal ACA reporting and the state individual mandate reporting, ACAwise can accurately and quickly report your Form MA 1099-HC with Massachusetts without any additional effort from

your end.

Send us your payroll, benefits, and employee census data through an excel template or use our own template. We will generate the Form MA 1099-HC and e-file it with the state of Massachusetts. We can also handle the distribution of your MA 1099-HC copies to your employees before the recipient copy deadline.

We simplify your MA Form 1099-HC reporting. Send us your requirements to [email protected] or contact us at

(704)-954-8420. Know more about our services.