Since the advent of ACA requirements by the IRS for businesses, ACAwise has provided a complete reporting solution to many small to large businesses and government entities. The largest county in the midwest region is one such customer of ACAwise. The county used this cloud-based SAAS solution to meet the ACA reporting requirements for more than 20,000 of its employees.

Software that meets all scenarios for the county

In order to meet the reporting requirements under IRC Sections 6055 and 6056, the IRS ACA business rules, and different complex scenarios that can come from a large population of employees, the software must code every business rule into its processing so that it can meet the needs of the business. The county with such a large population needs such software.

For instance, from covering participants that range from COBRA coverage, fully-insured coverage, Rehires, to processing data that comes from two different systems with different data characteristics, ACAwise has automated all of them.

As a result, the county has attained efficiency in meeting the ACA requirements with accurate filing.

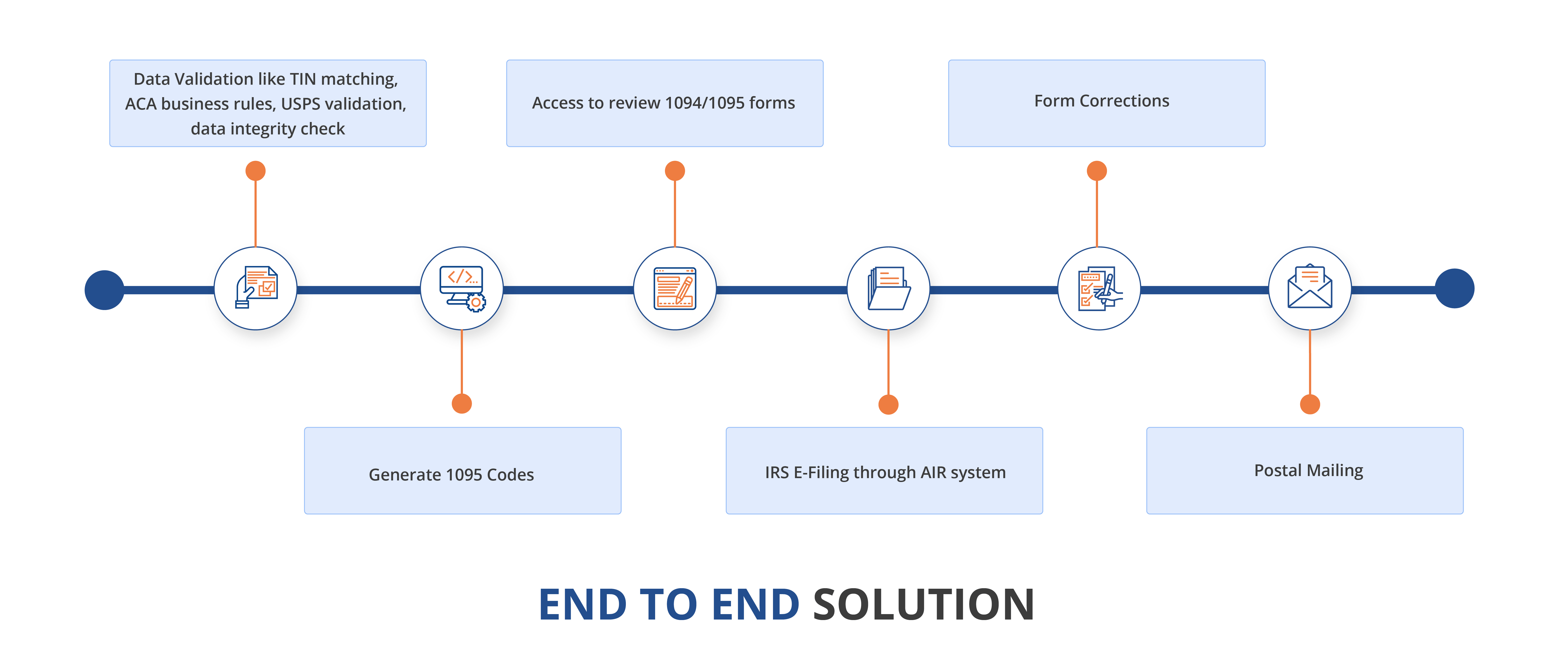

A complete end-to-end solution for the county

In addition to determining correct ACA codes, ACAwise performs data integrity checks and various pre-validation steps such as TIN mismatch reporting and USPS address validations, which would enable the county to address those issues proactively. These enablers provide complete visibility to the county to address any data-related issues such as TIN missing or any postal mail delivery issues to its employees. ACAwise offers such visibility to the county in every step of the way.

For instance, the solution allows the county to review and make corrections to the data using a secure portal. In the case of addresses that fail validations, the county is allowed to correct the employees’ addresses, thus ensuring the delivery of the mailed forms to the right address. Similarly, early TIN mismatch identification provides the county with the capability to take a reasonable effort to provide the correct TIN. We generate the 1095 forms with codes only after the county gives the go-ahead.

As a result, the county has adequate visibility and tracking mechanisms to ensure accurate e-filing with the IRS and postal mailing of recipient copies to its employees. Corrections are allowed on the ones that are rejected by the IRS.

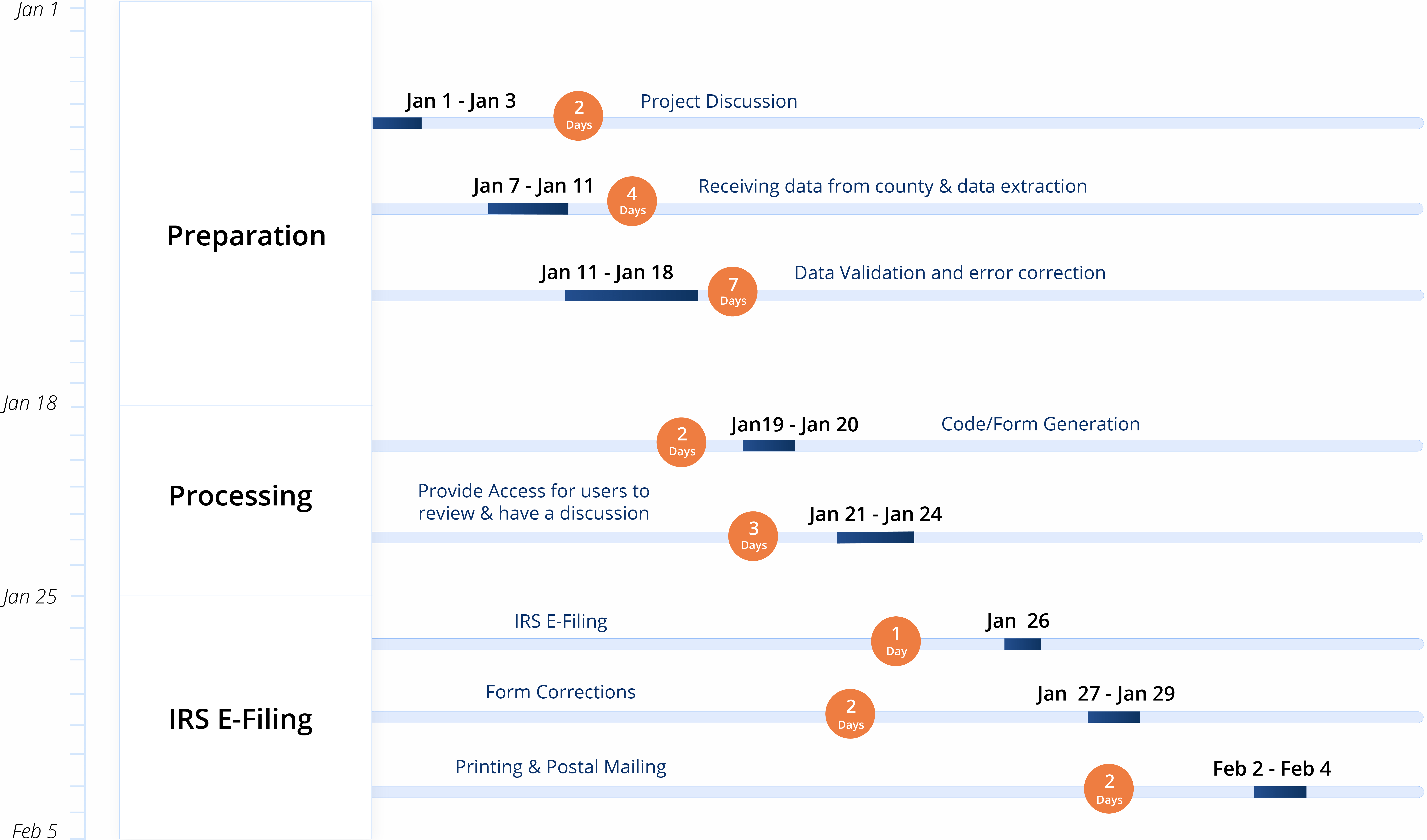

A detailed project plan to execute

An accurate software to meet the business rules and an end-to-end solution to cover all process scenarios are just necessary conditions but not sufficient enough to keep the business successful.

A detailed project plan that wraps the process and execution offers such sufficient conditions. Therefore, the ACAwise project management office (PMO) ensures the project plan covers all tasks, subtasks, milestones, responsible and accountable resources, change management, tracking and following up with issues - all in one highly visible and reportable fashion so that all stakeholders can take necessary actions to ensure success.

As a result, the county was well prepared on their ACA reporting before the looming deadlines arrived— yet another successful project execution for the county.

Finally, all is calm.